Emerging Real Estate Markets to Watch in 2023

- October 2, 2023

- admin

- Category: National Housing Market, Property Management, Real Estate, Real Estate Investing

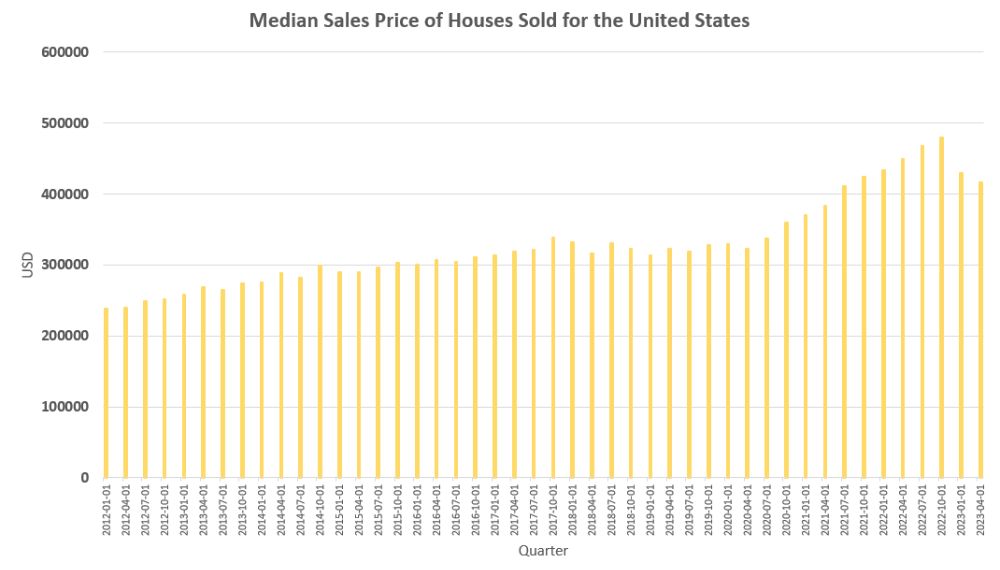

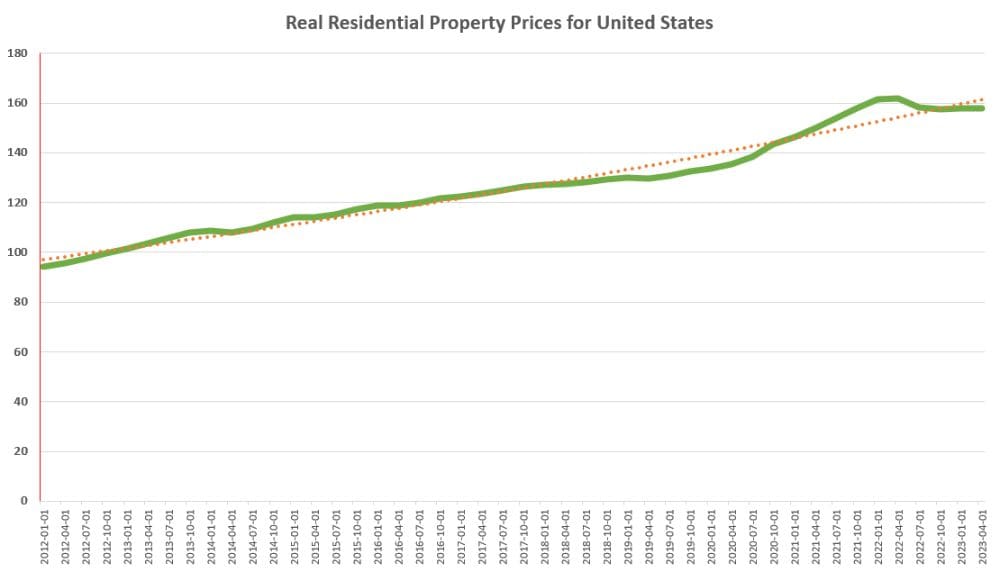

After two years of constant growth in property prices, the residential housing market in the United States experienced a significant slowdown during the first half of 2022, which continued into the early months of 2023.

With property prices climbing up the chart by 40% during these two years, many investors and buyers are now facing difficulties to afford new properties. With little space for doubt in mind related to future growth prospects and rising inflation across sectors, combined with declines in the stock market, have made it more challenging for people to save enough money for investing in emerging real estate markets.

Higher interest rates is another factor that has increased borrowing costs, making it harder for buyers and first-time purchasers who have limited down payment funds.

As a result of these factors combined, there has been a decrease in market activity. One area that has been significantly affected by these developments is home sale prices. The surge in housing prices was particularly prominent during COVID-19 when low-interest rates, increased household savings, and strong investment returns coincided with people spending time at home. The year-over-year growth rate reached a peak of 26.1% in May 2021. Remained at double-digit percentage growth until mid-2022. However, by the end of 2022, home prices had only risen modestly by 1.3% compared to the year prior.

However, some parts of the country have defied the norm and shown decent levels of real estate activity in the beginning of 2023. While prices have remained stable in specific areas states, some regions have experienced a trend of homes being sold at prices higher than their initial listing. Some markets have shown resilience despite the overall decline in housing demand.

Data: Statista

To identify the hottest real estate markets for 2023, we will discuss some key indicators and the overall market outlook. Here are some key indicators that can help you give a perspective on the market:

- One-year change in median sale price (with higher values ranking higher)

- The proportion of homes sold above the asking price (with higher values ranking higher)

- Number of days a property remains on the market (with lower values ranking higher)

- Sale-to-list percentage (with higher values ranking higher)

- Percentage of listings with price reductions (with lower values ranking higher)

In the next section, you will find the top six emerging markets with the most dynamic real estate and potential for growth.

50 Emerging Real Estate Markets to Lookout for in 2023

Let us understand the specifics of each of the 50 top emerging real estate markets in the US to look out for in 2023. First, let us understand the top 10.

Top 10 Emerging Real Estate Markets

#1 Charlotte (North Carolina)

| MSP | $390,537 |

| One-Year % Change in Median Sale Price | +6.8% |

| Homes Sold Above Asking | 48.9% |

| Average Days on the Market | 31.2 |

| Sale-to-List Percentage | 101.4% |

| Percentage of Listings with Price Reductions | 24.0% |

Situated in the heart of North Carolina, Charlotte is a city known for its economy, vibrant culture, and abundance of outdoor activities. With a growing population and thriving job market, Charlotte’s real estate sector is expected to experience growth in the coming years. The projected market outlook for the year indicates an 8.2% increase, presenting an excellent opportunity for investors.

Situated in the heart of North Carolina, Charlotte is a city known for its economy, vibrant culture, and abundance of outdoor activities. With a growing population and thriving job market, Charlotte’s real estate sector is expected to experience growth in the coming years. The projected market outlook for the year indicates an 8.2% increase, presenting an excellent opportunity for investors.

One compelling reason to consider investing in Charlotte’s real estate market is the city’s job market. With a range of industries and major companies like Bank of America and Duke Energy headquartered here, Charlotte maintains an unemployment rate and continues to attract more people. These factors contribute to the demand for properties within the city.

#2 Austin (Texas)

| MSP | $604,344 |

| One-Year % Change in Median Sale Price | -3.9% |

| Homes Sold Above Asking | 47.1% |

| Average Days on the Market | 37.2 |

| Sale-to-List Percentage | 97.1% |

| Percentage of Listings with Price Reductions | 42.5% |

The market has seen some disruptions due to all the commotion. Despite the nationwide inflation and rising interest rates, Austin will remain a popular place for sellers. The Austin Metropolitan Statistical Area (MSA) prices are still climbing because of an influx of new residents and a rapidly recovering local economy.

#3 Aurora (Colorado)

| MSP | $476,319 |

| One-Year % Change in Median Sale Price | -1.3% |

| Homes Sold Above Asking | 54.5% |

| Average Days on the Market | 10.7 |

| Sale-to-List Percentage | 102.4% |

| Percentage of Listings with Price Reductions | 44.3% |

The city encompasses industries including transportation, commercial centers, healthcare facilities, and government services. Job opportunities in Aurora are projected to grow by 42% over the next decade. These factors make it an appealing prospect for buyers. Investors can confidently regard Aurora as a long-term investment opportunity.

Aurora has exceptional public schools, low crime rates, family-friendly neighborhoods, and progressive values.

#4 Raleigh (North Carolina)

| MSP | $410,064 |

| One-Year % Change in Median Sale Price | -1.3% |

| Homes Sold Above Asking | 55.6% |

| Average Days on the Market | 30.8 |

| Sale-to-List Percentage | 103.1% |

| Percentage of Listings with Price Reductions | 23.9% |

With a large community of students in Raleigh, it offers a good growth opportunity for real estate investors looking to invest in something and earn passive income. In addition to being the location of three known universities, job opportunities are on the horizon.

The presence of institutions and the promising job market have led to a community of renters with steady incomes. Raleigh is currently experiencing an increase in both housing prices and rental rates, which reflects its status as one of the best housing markets in the country.

#5 El Paso (Texas)

| MSP | $231,843 |

| One-Year % Change in Median Sale Price | +9.3% |

| Homes Sold Above Asking | 48.3% |

| Average Days on the Market | 19.9 |

| Sale-to-List Percentage | 101.0% |

| Percentage of Listings with Price Reductions | 16.6% |

The real estate market in El Paso is receiving support from the economy, particularly regarding job opportunities. While the local unemployment rate is comparable to the national average, there has been a notable increase of 2.3 percent in job growth over the past year, surpassing the national average by nearly half a percentage point. These statistics suggest that El Paso’s job market is outperforming other regions.

El Paso’s real estate market may not be on par with other cities in Texas, but it has shown progress since the recession. The job sector is also strengthening, which is expected to benefit those who are currently investing in real estate in El Paso.

#6 Oakland (California)

| MSP | $906,959 |

| One-Year % Change in Median Sale Price | -0.9% |

| Homes Sold Above Asking | 72.1% |

| Average Days on the Market | 18.9 |

| Sale-to-List Percentage | 113.1% |

| Percentage of Listings with Price Reductions | 22.6% |

Oakland seems to be a sought-after market for sellers at the moment. Many investors and individuals are searching for homes; surprisingly, there is a bit of a shortage from the seller’s side. This situation could be a chance for investors who know how to navigate the market.

Over the ten years, Oakland has experienced growth in its real estate sector. Currently, local home values are reaching all-time highs, causing many people to question whether it’s the time to take action.

#7 Dallas (Texas)

| MSP | $417,510 |

| One-Year % Change in Median Sale Price | -11.5% |

| Homes Sold Above Asking | 46.7% |

| Average Days on the Market | 21.8 |

| Sale-to-List Percentage | 101.4% |

| Percentage of Listings with Price Reductions | 26.0% |

Many investors have been questioning the viability of purchasing property in Dallas. To gain insight into the 2023 real estate market for both investors and regular buyers, it is essential to research trends. The housing market in Dallas presents a great opportunity if you are interested in expanding your real estate portfolio with deals with great potential.

Regarding real estate, the importance of location cannot be overstated, and Dallas excels in this aspect. In fact, Dallas leads the nation with 11,636 approved projects that include both single-family and joint-family units. This statistic highlights the potential of Dallas within the real estate industry.

#8 Jacksonville (Florida)

| MSP | $299,529 |

| One-Year % Change in Median Sale Price | -1.1% |

| Homes Sold Above Asking | 34.4% |

| Average Days on the Market | 28.0 |

| Sale-to-List Percentage | 99.2% |

| Percentage of Listings with Price Reductions | 29.0% |

As of July 31, 2023, the Jacksonville housing market is showing a great projection for the future. When investing, it’s essential to balance both the value and the strategy. If your goal is solely to generate high monthly rental income, buying real estate in Jacksonville may not be the most suitable choice. However, if you’re a savvy investor with a long-term vision, Jacksonville could be an excellent opportunity.

#9 Tampa (Florida)

| MSP | $390,967 |

| One-Year % Change in Median Sale Price | +10.6% |

| Homes Sold Above Asking | 40.4% |

| Average Days on the Market | 14.5 |

| Sale-to-List Percentage | 99.9% |

| Percentage of Listings with Price Reductions | 31.1% |

Tampa, situated in Hillsborough County, is a city known for its walkability. It has a population of 335,749 residents. When we consider the area of Greater Tampa Bay, which includes both Tampa and Sarasota metro regions, the population expands to over 4 million. This region not only serves as an urban center but also holds significant appeal as a popular tourist destination.

Recently, Tampa has been gaining attention for its thriving housing market, attracting investors. The rental market in the Tampa Bay area displays strength, making it an excellent choice for those purchasing rental properties in Florida.

#10 Madison (Wisconsin)

| MSP | $365,389 |

| One-Year % Change in Median Sale Price | +6.4% |

| Homes Sold Above Asking | 57.4% |

| Average Days on the Market | 39.6 |

| Sale-to-List Percentage | 103.4% |

| Percentage of Listings with Price Reductions | 12.4% |

Currently, Madison, Wisconsin, is experiencing a seller’s market, indicating a demand for properties in the area. This increased demand can be attributed to Madison’s location, thriving economy, and exceptional quality of life.

Madison stands out as it is home to the University of Wisconsin Madison, creating a need for rental properties. Additionally, the city boasts a job market supported by known employers, like American Family Insurance and the University of Wisconsin Madison.

Other 40 Emerging Real Estate Markets To Watch For

#11 Salt Lake City (Utah)

| MSP | $553,421 |

| One-Year % Change in Median Sale Price | +1.6% |

| Homes Sold Above Asking | 46.6% |

| Average Days on the Market | 19.4 |

| Sale-to-List Percentage | 101.3% |

| Percentage of Listings with Price Reductions | 36.4% |

Salt Lake City in Utah often goes unnoticed by real estate investors. Often overlooked by investors, it is nearly half of the job opportunities in Utah, and 40% of its population can be found within Salt Lake.

Salt Lake City has emerged as a “number one” choice for long-term investments in properties across the US. Not only this, recent data shows that this understated city, since the last decade or so, has shown an appreciation rate of 161.55%, resulting in an average annual home appreciation rate of 10.09%. This accomplishment puts Salt Lake City among the 10% of cities nationwide regarding real estate value growth.

#12 Nashville-Davidson (Tennessee)

| MSP | $453,068 |

| One-Year % Change in Median Sale Price | +2.1% |

| Homes Sold Above Asking | 44.4% |

| Average Days on the Market | 29.3 |

| Sale-to-List Percentage | 101.1% |

| Percentage of Listings with Price Reductions | 25.7% |

Nashville, Tennessee, is famous for its known attractions, such as the Grand Ole Opry, a replica of the Parthenon, and its lively country music. As a tourist destination in the heart of America, Nashville has established itself as a city with its unique charm. Nashville, with a population of over 600,000 residents, is one of the most populous cities in the United States. When we take into account the areas within Davidson County, the Nashville real estate market encompasses around 700,000 people.

Over the past years, the housing market in Nashville Davidson has been highly favorable for sellers with rising property prices. It has garnered a reputation as one of the most desirable housing markets in the United States. This positive trend in real estate started a decade ago, and experts anticipate that it will continue well into 2023 and beyond.

#13 Orlando (Florida)

| MSP | $353,400 |

| One-Year % Change in Median Sale Price | +2.9% |

| Homes Sold Above Asking | 37.6% |

| Average Days on the Market | 15.1 |

| Sale-to-List Percentage | 99.6% |

| Percentage of Listings with Price Reductions | 26.8% |

The real estate market in Orlando has a lot of potential for growth because of its expansion and the increasing number of people moving to the city. Since 2018, Orlando has maintained stability mostly due to its tourism industry. However, it’s not only tourism that plays a role in the city’s economy. Nashville has also emerged as a center for high-tech industries.

With the increase in job opportunities, Orlando has become a popular choice for people from various parts of the country and even abroad to settle down. This growing trend has resulted in a higher demand for both residential and commercial properties. For investors seeking profitable rental income, Orlando is worth considering as over 46% of households in the city are occupied by renters.

#14 Boise (Idaho)

| MSP | $514,184 |

| One-Year % Change in Median Sale Price | -1.6% |

| Homes Sold Above Asking | 26.2% |

| Average Days on the Market | 20.0 |

| Sale-to-List Percentage | 99.3% |

| Percentage of Listings with Price Reductions | 48.8% |

Lately, the housing market in all over the US has seen a dip, and Idaho was not spared. But that’s not why it is on this list. Idaho is still attracting interest because it’s affordable and offers a quality of life. If there’s no supply, sellers might have chances to raise prices and wait for the buyer patiently.

#15 Charleston (South Carolina)

| MSP | $493,750 |

| One-Year % Change in Median Sale Price | +10.2% |

| Homes Sold Above Asking | 35.2% |

| Average Days on the Market | 43.8 |

| Sale-to-List Percentage | 100.1% |

| Percentage of Listings with Price Reductions | 17.8% |

Charleston’s real estate market often goes unnoticed compared to the other markets, like in Texas and Florida. However there are reasons why property investors find Charleston an attractive destination. This coastal city has consistently shown growth, making it an appealing option for those interested in real estate investment.

Charleston is known for being favorable to landlords. The city’s economic prospects indicate that housing demand and rental rates will continue to rise, making it a more encouraging buy for real estate investors.

#16 Knoxville (Tennessee)

| MSP | $293,612 |

| One-Year % Change in Median Sale Price | +7.3% |

| Homes Sold Above Asking | 46.6% |

| Average Days on the Market | 40.5 |

| Sale-to-List Percentage | 101.1% |

| Percentage of Listings with Price Reductions | 22.9% |

With mortgage rates at their highest levels in ten years and concerns about inflation, the housing frenzy caused by the pandemic is naturally calming down. However, the real estate market in Knoxville is handling it really well, and even the MSP has changed substantially in favor of Knoxville, where other investors are facing substantial losses.

Investing in the Knoxville real estate market might be a good choice for those looking for the right entry points and potential solid growth of their portfolio.

#17 Des Moines (Iowa)

| MSP | $189,597 |

| One-Year % Change in Median Sale Price | +2.9% |

| Homes Sold Above Asking | 36.8% |

| Average Days on the Market | 12.7 |

| Sale-to-List Percentage | 99.4% |

| Percentage of Listings with Price Reductions | 38.5% |

Des Moines has a foundation for growth. Des Moines boasts an impressively low unemployment rate of just 3.9 percent, well below the national average of around 5.6 percent. However, the city could work towards increasing its job growth rate, which currently stands at 1.1 percent, nearly half the national average of 1.9 percent. If Des Moines can continue to produce positive economic indicators like this in the future, investors may see substantial returns, particularly in the thriving housing market.

#18 Miami (Florida)

| MSP | $533,410 |

| One-Year % Change in Median Sale Price | +9.6% |

| Homes Sold Above Asking | 22.2% |

| Average Days on the Market | 55.1 |

| Sale-to-List Percentage | 97.5% |

| Percentage of Listings with Price Reductions | 12.4% |

In the ten years, real estate market in Miami has experienced growth with an overall appreciation of 188.09%. This impressive figure translates to an annual appreciation rate of 11.16%, placing Miami in the top 10% nationwide.

However, whether purchasing a house in Miami is advisable depends on circumstances and objectives. Considering the potential for increases in home value so far, it may present a favorable opportunity for buyers with long-term investment goals or those capable of making quick decisions in this fast-paced market.

#19 Omaha (Nebraska)

| MSP | $254,817 |

| One-Year % Change in Median Sale Price | +8.9% |

| Homes Sold Above Asking | 51.8% |

| Average Days on the Market | 7.8 |

| Sale-to-List Percentage | 102.1% |

| Percentage of Listings with Price Reductions | 29.5% |

The real estate market in Omaha is poised for long-term growth largely due to its demographics. The average age of residents is 35, which is younger than the state average. The presence of colleges in the housing market further influences the young population in Omaha. Moreover, many college graduates choose to stay in this job market. This contributes to increased demand for property value in Omaha, which is remarkable considering it’s a region known for its declining small towns.

The market’s resilience can be attributed to factors such as a supply of affordable starter homes and a strong economy that attracts individuals from across the region seeking employment opportunities here.

#20 Tallahassee (Florida)

| MSP | $231,369 |

| One-Year % Change in Median Sale Price | +15.9% |

| Homes Sold Above Asking | 38.7% |

| Average Days on the Market | 42.7 |

| Sale-to-List Percentage | 99.8% |

| Percentage of Listings with Price Reductions | 12.4% |

Since August 2023, there has been a rise, in home prices in Tallahassee. In fact, they have increased by 15.9% compared to the last year. This price surge can be attributed to a combination of factors that have come together to shape the housing market in the city.

One major factor contributing to this price increase is the availability of constructed homes. Previous years have faced a decrease in housing projects that created a shortage – which in turn led to this growth.

#21 Denver (Colorado)

| MSP | $589,325 |

| One-Year % Change in Median Sale Price | -3.6% |

| Homes Sold Above Asking | 49.8% |

| Average Days on the Market | 10.4 |

| Sale-to-List Percentage | 102.5% |

| Percentage of Listings with Price Reductions | 38.5% |

Denver has consistently proven itself to be one of the best long-term real estate investments in the United States. The city’s strong economy is a factor in its reputation as it allows buyers to allocate financial resources towards housing, which drives up real estate prices.

Looking ahead to the year 2023, the market forecast predicts a growth rate of 3.5%. This forecast suggests an outlook for the Denver housing market, indicating a potential recovery from the recent decline in real estate values. It’s news for both homeowners and prospective buyers. A noteworthy indicator of market stability is the number of days it takes for a property to sell, which is 10.4 days as of the recent data of 2023. This short period emphasizes that properties are quickly transitioning due to the demand for homes in the Denver area. This strong demand solidifies Denver’s position as an attractive long-term investment opportunity.

#22 San Jose (California)

| MSP | $1,330,942 |

| One-Year % Change in Median Sale Price | -8.9% |

| Homes Sold Above Asking | 65.9% |

| Average Days on the Market | 16.6 |

| Sale-to-List Percentage | 106.9% |

| Percentage of Listings with Price Reductions | 26.1% |

San Jose’s real estate market has been a top choice for long-term investments across the country for the past decade. The housing landscape in San Jose consists of a mix of owner-occupied and rental properties.

Despite some decreases in home prices, the market remains highly competitive. In fact, an impressive 65.9% of properties sell above their listed prices, with a projected growth rate of 1.7%. It is worth noting that the decline in prices may be a necessary adjustment within the market rather than an indication of a slowing market overall.

#23 Columbus (Ohio)

| MSP | $259,695 |

| One-Year % Change in Median Sale Price | +6.4% |

| Homes Sold Above Asking | 52.6% |

| Average Days on the Market | 36.2 |

| Sale-to-List Percentage | 102.3% |

| Percentage of Listings with Price Reductions | 20.9% |

Investing in Columbus presents a range of opportunities, from single-family residences to apartment complexes with multiple units. The city has an economy, an unemployment rate, and a steadily growing population, making it an attractive market for rental properties.

However, it’s important to choose the right location. For example, Italian Village has a home value of $397,113, whereas in Milo Grogan, it’s $114,460. Therefore it is highly recommended to conduct research on neighborhoods and seek guidance from local real estate experts who have extensive knowledge of the market.

#24 San Diego (California)

| MSP | $869,443 |

| One-Year % Change in Median Sale Price | -1.1% |

| Homes Sold Above Asking | 52.4% |

| Average Days on the Market | 15.9 |

| Sale-to-List Percentage | 102.2% |

| Percentage of Listings with Price Reductions | 12.4% |

The real estate market in San Diego is known for being one of the most expensive in the country, although there are cities on the West Coast that surpass it in terms of cost. This pricing situation has led to increased demand for rental properties in San Diego, specifically for those who face financial challenges when it comes to owning a home.

With the expected population growth of 500,000 people by 2050, which is steadily increasing by tens of thousands each year by the way, the rental market is set to experience expansion. Currently, the average rent in San Diego is $2,700 per month, and it can be much higher depending on the location and availability.

#25 Reno (Nevada)

| MSP | $543,806 |

| One-Year % Change in Median Sale Price | -2.9% |

| Homes Sold Above Asking | 34.1% |

| Average Days on the Market | 38.4 |

| Sale-to-List Percentage | 99.5% |

| Percentage of Listings with Price Reductions | 29.8% |

Reno is an amazing destination for tourists. Its attractions like the beautiful Lake Tahoe and the exciting Reno Air Races, are one of the exciting places tourists can visit here. For those interested in real estate investment, the thriving tourism industry in Reno offers an income opportunity through short-term rentals and vacation homes.

Additionally, Reno’s strategic placement with close distance to cities like San Francisco, Sacramento and Las Vegas makes it an attractive choice for both businesses and residents. Subsequently, it increases housing demand, making Reno a promising market for real estate investors.

#26 Phoenix (Arizona)

| MSP | $441,268 |

| One-Year % Change in Median Sale Price | -1.4% |

| Homes Sold Above Asking | 39.6% |

| Average Days on the Market | 33.4 |

| Sale-to-List Percentage | 100.0% |

| Percentage of Listings with Price Reductions | 31.6% |

Phoenix has experienced a significant rise in its population, but the housing market has not kept up with the pace creating demand for housing. According to a study, Arizona fell short by 505,134 housing units between 2000 and 2015. This shortage has resulted in a housing crisis in Phoenix. To put it into perspective, over the thirty years or so, around 220,000 new housing units were built in Phoenix while the population surged by a staggering figure of 820,000 people. It’s quite clear that the rate of housing production in Phoenix hasn’t been able to match the increase in population.

The presence of universities within the city also plays a role in shaping housing prices and rental rates. These campuses collectively accommodate over seventy thousand students, which further impacts positively the housing landscape.

#27 Elk Grove (California)

| MSP | $642,447 |

| One-Year % Change in Median Sale Price | -12.5% |

| Homes Sold Above Asking | 56.5% |

| Average Days on the Market | 17.0 |

| Sale-to-List Percentage | 101.5% |

| Percentage of Listings with Price Reductions | 38.4% |

The historic district of Elk Grove is a hub that brings the community together. Elk Grove, as a whole, offers a variety of properties to cater to everyone’s tastes. Whether you’re looking for ranches with plenty of land, luxurious homes with stunning golf course views, or charming family residences tucked away on suburban streets, you’ll find your perfect fit right here.

Although the recent decline indicates a “slippery” slope but the long-term view provides a look at many opportunities here. With 56.5% of homes selling above the asking price with an average of just 17 days in the market.

#28 Seattle (Washington)

| MSP | $844,285 |

| One-Year % Change in Median Sale Price | +0.6% |

| Homes Sold Above Asking | 42.7% |

| Average Days on the Market | 11.0 |

| Sale-to-List Percentage | 103.5% |

| Percentage of Listings with Price Reductions | 26.9% |

Seattle’s housing market is booming – This surge can be primarily attributed to the arrival of paid tech professionals from companies like Amazon, Microsoft, Google, and Facebook. Workforces from these companies are actively seeking homes with dedicated workspaces, which has become a growing trend during the pandemic when remote work became prevalent.

Although there has been an increase in housing inventory, the real estate market in the Puget Sound region remains tight. There is less than a two-month supply of homes, making it a seller’s market where limited properties face demand from buyers. As a result, home prices will likely stay at the top for the foreseeable future.

#29 Lincoln (Nebraska)

| MSP | $269,829 |

| One-Year % Change in Median Sale Price | +11.1% |

| Homes Sold Above Asking | 51.0% |

| Average Days on the Market | 10.1 |

| Sale-to-List Percentage | 101.3% |

| Percentage of Listings with Price Reductions | 17.4% |

The housing market in Lincoln, Nebraska is an example of how gradual growth can bring great advantages. Although the increase in home prices may not be extremely impressive the presence of elements suggests that this growth is sustainable.

A combination of factors such as unemployment rates, robust job growth, managed foreclosure levels, and high affordability all contribute to an economy that can handle small fluctuations. With continued expansion, the real estate market in Lincoln has the potential to set an example for other cities across the USA to follow.

#30 Houston (Texas)

| MSP | $319,747 |

| One-Year % Change in Median Sale Price | +0.0% |

| Homes Sold Above Asking | 30.1% |

| Average Days on the Market | 21.2 |

| Sale-to-List Percentage | 98.9% |

| Percentage of Listings with Price Reductions | 26.4% |

The Houston housing market is currently balanced between buyers and sellers. While home values did experience a slight decline over the past year, future indicators suggest the potential for growth. With a diverse range of pricing strategies and quick pending transaction times, both buyers and sellers have advantageous opportunities. To make well-informed decisions in this market, individuals should assess their objectives, gather valuable market insights, and seek guidance from industry experts.

#31 Atlanta (Georgia)

| MSP | $410,742 |

| One-Year % Change in Median Sale Price | +2.6% |

| Homes Sold Above Asking | 39.3% |

| Average Days on the Market | 24.1 |

| Sale-to-List Percentage | 99.9% |

| Percentage of Listings with Price Reductions | 24.6% |

Atlanta has consistently ranked as one of the best real estate markets for investors, especially when it comes to investing in rental properties. The city has experienced population growth, with around 285,000 people moving to Georgia in 2019. This increase in migration can be credited to Atlanta’s business environment and its reputation for being more affordable compared to big cities. As a result, there is a growing demand for housing in Atlanta that surpasses the rate of construction.

The shortage of housing remains a challenge in Atlanta. It is expected that this scarcity will continue driving up property prices in the foreseeable future.

#32 Riverside (California)

| MSP | $597,515 |

| One-Year % Change in Median Sale Price | -2.6% |

| Homes Sold Above Asking | 57.5% |

| Average Days on the Market | 29.0 |

| Sale-to-List Percentage | 101.3% |

| Percentage of Listings with Price Reductions | 24.1% |

Riverside is a vibrant city that offers benefits for people looking to buy homes or invest in the real estate market. The city boasts a population with a thriving economy and a wide variety of housing options. The Riverside real estate market has been on a trajectory, with home prices consistently increasing.

Several key factors contribute to this trend in the Riverside real estate market. One of these factors is the economy, supported by major employers like Kaiser Permanente and the University of California. Additionally, Riverside’s strategic location near Los Angeles plays a role in driving its real estate growth. Being just a short distance away from Los Angeles makes Riverside an attractive choice for many commuters.

#33 Port St. Lucie (Florida)

| MSP | $384,165 |

| One-Year % Change in Median Sale Price | +16.1% |

| Homes Sold Above Asking | 34.9% |

| Average Days on the Market | 42.5 |

| Sale-to-List Percentage | 99.6% |

| Percentage of Listings with Price Reductions | 24.3% |

The housing market, in Port St. Lucie has seen a constant trend for the past few years. This can be attributed to the growing demand for homes combined with a supply of properties.

Moreover, the city’s advantageous location on the East Coast near centers such as Miami and West Palm Beach has contributed to the increased demand. As a result, property prices in Port St. Lucie have been steadily rising, making it an attractive option for both homeowners and investors.

#34 Virginia Beach (Virginia)

| MSP | $336,786 |

| One-Year % Change in Median Sale Price | +4.6% |

| Homes Sold Above Asking | 54.9% |

| Average Days on the Market | 19.2 |

| Sale-to-List Percentage | 101.6% |

| Percentage of Listings with Price Reductions | 19.9% |

Virginia Beach is known for being a location for real estate investments due to its strong and competitive housing market. With a range of property choices from beachfront houses to condos, townhouses, and large single-family homes, there is something for everyone. Looking ahead, the future looks promising for Virginia Beach’s real estate scene, with a projected growth rate of 4.4% by next year.

#35 Huntsville (Alabama)

| MSP | $325,483 |

| One-Year % Change in Median Sale Price | -0.9% |

| Homes Sold Above Asking | 43.1% |

| Average Days on the Market | 26.6 |

| Sale-to-List Percentage | 101.2% |

| Percentage of Listings with Price Reductions | 19.8% |

Huntsville real estate market stands out for being surprisingly affordable compared to markets even those facing less favorable economic conditions. The city boasts a thriving economy, a strong job market, and housing that remains easily accessible to residents.

These factors combined make Huntsville’s real estate sector benefit from a blend of circumstances. Additionally, home values in Huntsville have consistently exceeded the average over the ten years.

#36 Bakersfield (California)

| MSP | $385,687 |

| One-Year % Change in Median Sale Price | +3.8% |

| Homes Sold Above Asking | 46.4% |

| Average Days on the Market | 19.1 |

| Sale-to-List Percentage | 100.5% |

| Percentage of Listings with Price Reductions | 27.2% |

Bakersfield, located in California, holds a place within the Inland Empire even though it often gets overshadowed by famous coastal cities like San Francisco and Los Angeles. Around 400,000 people call Bakersfield home within its city limits, which makes it the largest city in California.

The real estate market in Bakersfield has been experiencing growth, placing it among the 10% nationally for property appreciation. Over the decade, property values in Bakersfield have seen an increase of 150.36 percent—equivalent to an average annual appreciation rate of 9.61 percent.

#37 Indianapolis (Indiana)

| MSP | $232,593 |

| One-Year % Change in Median Sale Price | +2.3% |

| Homes Sold Above Asking | 40.2% |

| Average Days on the Market | 9.1 |

| Sale-to-List Percentage | 100.1% |

| Percentage of Listings with Price Reductions | 37.9% |

The real estate market in Indianapolis has been marked by competition and quick sales, often leading to properties being bought at higher prices than their initial listings. The one-year market forecast predicts a growth projection of 7.6%, indicating a demand in the future. This forecast reinforces the notion that the market is not showing any signs of slowing down but rather maintaining its momentum.

#38 Richmond (Virginia)

| MSP | $339,168 |

| One-Year % Change in Median Sale Price | +7.7% |

| Homes Sold Above Asking | 58.8% |

| Average Days on the Market | 10.6 |

| Sale-to-List Percentage | 104.1% |

| Percentage of Listings with Price Reductions | 28.1% |

Richmond, the capital city of Virginia (VA), offers a vibrant blend of culture, history, and economic opportunities. Its diverse economy is flourishing in various sectors. Experts predict that the Richmond real estate market will continue to experience growth, with prices expected to rise gradually rather than seeing a surge. However, limited inventory may lead potential homebuyers to face competition and potentially pay above the asking price for desirable properties.

If you’re a landlord or property investor, it might be worth considering the Richmond rental market. Indications show that rental prices are on the rise, and the market is gaining momentum. However, potential buyers may encounter difficulties due to mortgage related challenges.

#39 Baltimore (Maryland)

| MSP | $216,060 |

| One-Year % Change in Median Sale Price | +6.6% |

| Homes Sold Above Asking | 36.6% |

| Average Days on the Market | 30.8 |

| Sale-to-List Percentage | 102.2% |

| Percentage of Listings with Price Reductions | 26.7% |

Baltimore is well-known for its affordable real estate market, particularly in comparison to cities like Los Angeles or New York. Investors have the opportunity to purchase properties at a significantly lower cost compared to these metropolitan areas. Additionally, Baltimore’s real estate market has seen consistent growth in the recent years, primarily due to its strong local economy.

The rental market in Baltimore is thriving due to several factors, including a growing population and relatively affordable living costs. This creates an appealing opportunity for investors looking to buy properties and rent them out to tenants.

#40 Wichita Falls (Texas)

| MSP | $152,697 |

| One-Year % Change in Median Sale Price | +47.2% |

| Homes Sold Above Asking | 21.2% |

| Average Days on the Market | 46.9 |

| Sale-to-List Percentage | 96.4% |

| Percentage of Listings with Price Reductions | 29.7% |

If you’re looking for homes that have the potential for flipping, Wichita Falls is a great choice for investing in properties. However, if you’re thinking of making it your permanent residence, you’ll discover that the cost of living in Wichita Falls is 1% lower compared to the state average and 9% lower than the average.

Moreover, housing expenses in Wichita Falls are 20% below the average across the United States. When you consider all these factors together, it becomes an investment opportunity.

#41 Portland (Oregon)

| MSP | $545,469 |

| One-Year % Change in Median Sale Price | -1.8% |

| Homes Sold Above Asking | 50.3% |

| Average Days on the Market | 14.1 |

| Sale-to-List Percentage | 102.4% |

| Percentage of Listings with Price Reductions | 36.0% |

Portland is a city that attracts homebuyers and real estate experts for several reasons. Its stunning landscapes, vibrant culture, and flourishing real estate market are just some of the factors that make it a desirable location. With a strong economy, growing population, and thriving rental market, Portland offers promising opportunities for real estate investment. Investors are drawn to the potential for long-term appreciation and consistent cash flow in this dynamic city.

Portland offers a strong job market as another appealing aspect for investors. The city is home to a range of industries, including technology, healthcare, education, and manufacturing. With the presence of major employers and a growing entrepreneurial ecosystem, Portland provides a stable economic environment that attracts potential tenants and buyers for investment properties.

#42 Lexington-Fayette (Kentucky)

| MSP | $292,038 |

| One-Year % Change in Median Sale Price | +11.4% |

| Homes Sold Above Asking | 42.0% |

| Average Days on the Market | 11.4 |

| Sale-to-List Percentage | 100.4% |

| Percentage of Listings with Price Reductions | 27.1% |

The population of Lexington is increasing, which has resulted in an increase, in the cost of living. However, when compared to cities across the country, Lexington remains quite affordable. Due to its college population, there are plenty of housing options available at reasonable prices. Whether you’re looking to rent or buy a home, your money can go further in Lexington than in American cities.

That being said, like metropolitan areas, housing prices in Lexington have been trending upward in recent years. For buyers who prefer neighborhoods with competition, it might be worth exploring areas such as Castlewood, Irishtown, or Eastland.

#43 Tulsa (Oklahoma)

| MSP | $218,904 |

| One-Year % Change in Median Sale Price | +4.0% |

| Homes Sold Above Asking | 41.3% |

| Average Days on the Market | 11.2 |

| Sale-to-List Percentage | 99.7% |

| Percentage of Listings with Price Reductions | 31.6% |

Over the past year, the housing market in Tulsa has experienced significant growth, with an average increase of 4% in home values. The median home value now stands at $218,904. Additionally, there is a strong seller’s market, as indicated by the current median sale-to-list ratio. Furthermore, homes are selling relatively quickly, with a short median days to pending sale. These trends point to a high demand for homes in Tulsa.

Tulsa’s rental market is thriving, with high demand for rental properties and low vacancy rates. This creates opportunities for investors to generate passive income through rentals. Additionally, Tulsa’s large student population makes it an attractive investment option, thanks to the presence of multiple colleges and universities in the area. These institutions include the University of Tulsa, Oral Roberts University, Oklahoma State University, and the Spartan School of Aeronautics.

#44 Arlington (Texas)

| MSP | $339,551 |

| One-Year % Change in Median Sale Price | +10.0% |

| Homes Sold Above Asking | 54.0% |

| Average Days on the Market | 20.1 |

| Sale-to-List Percentage | 101.9% |

| Percentage of Listings with Price Reductions | 30.9% |

Arlington offers an ideal location and affordable real estate options, combining the benefits of suburban living with convenient access to a major city. With its diverse business scene, Arlington is an attractive choice for real estate investment. The city boasts a wide range of businesses and employers, from large corporations to small enterprises. Its prime location has contributed to a thriving real estate market, with high demand for homes, including luxury properties.

#45 Cape Coral (Florida)

| MSP | $414,440 |

| One-Year % Change in Median Sale Price | +8.5% |

| Homes Sold Above Asking | 31.7% |

| Average Days on the Market | 17.3 |

| Sale-to-List Percentage | 99.1% |

| Percentage of Listings with Price Reductions | 32.7% |

Now is a time to explore your options if you’re thinking about buying a home in Cape Coral. The prices of homes are still quite affordable. There are plenty of choices. However it’s an idea to act because the market is expected to soften in the next few months gradually.

When it comes to the cost of living, Cape Coral is slightly higher than the average. It’s important to keep in mind that Cape Coral is a tourist spot during the winter season, which can lead to more traffic and congestion. Cape Coral School District has an average ranking, making it more appealing as a place to live.

#46 Sacramento (California)

| MSP | $497,707 |

| One-Year % Change in Median Sale Price | -5.8% |

| Homes Sold Above Asking | 56.2% |

| Average Days on the Market | 15.2 |

| Sale-to-List Percentage | 101.6% |

| Percentage of Listings with Price Reductions | 37.5% |

Sacramento County, located in the heart of the Central Valley region, is a lively area. It has a history, a culture, and a strong economy that have all attracted many people looking for a great quality of life and promising opportunities.

The county’s prime location along with its transportation infrastructure and abundance of amenities, has made it very appealing to both residents and those from out of state who are looking to buy homes. The housing market in Sacramento has experienced an increase in sales activity, although the median sales price has decreased. One significant factor contributing to this trend is the availability of homes for sale, which has decreased by 46% compared to the year.

#47 Sioux Falls (South Dakota)

| MSP | $300,959 |

| One-Year % Change in Median Sale Price | +13.4% |

| Homes Sold Above Asking | 48.9% |

| Average Days on the Market | 42.6 |

| Sale-to-List Percentage | 101.9% |

| Percentage of Listings with Price Reductions | 9.4% |

Sioux Falls has become a spot for real estate investors in the few years due to its strong economy, affordable housing choices, and excellent quality of life. If you’re thinking about investing in the Sioux Falls real estate market, there are plenty of reasons to explore this opportunity.

The city has a diverse economy, with major employers in healthcare, finance, and manufacturing playing roles. This economic vitality has led to a demand for housing in the rental market.

#48 Greensboro (North Carolina)

| MSP | $255,741 |

| One-Year % Change in Median Sale Price | +16.4% |

| Homes Sold Above Asking | 56.4% |

| Average Days on the Market | 22.1 |

| Sale-to-List Percentage | 101.9% |

| Percentage of Listings with Price Reductions | 21.9% |

Greensboro, NC, is currently experiencing a seller’s market, where there is high demand for homes but limited inventory available. As a result, sellers have the advantage, often selling their homes at or close to the listing price. The shortage of available homes and the fast pace of sales contribute to this seller’s market.

#49 Providence (Rhode Island)

| MSP | $379,048 |

| One-Year % Change in Median Sale Price | +11.4% |

| Homes Sold Above Asking | 58.7% |

| Average Days on the Market | 22.7 |

| Sale-to-List Percentage | 102.3% |

| Percentage of Listings with Price Reductions | 17.2% |

The Providence real estate market maintains a relatively high level of affordability. While it may not match the prices of properties in Toledo, Providence still offers more affordability than the majority of markets nationwide. Notably, affordability remains robust within the Providence housing market and displays no indications of decline.

For context, homeowners in Providence typically allocate around 11.1 percent of their income to cover monthly mortgage payments. In contrast, the national average hovers at approximately 15.1 percent. In essence, living in Providence proves to be more cost-effective than residing in most other markets throughout the country.

#50 Las Vegas (Nevada)

| MSP | $410,488 |

| One-Year % Change in Median Sale Price | -1.3% |

| Homes Sold Above Asking | 41.1% |

| Average Days on the Market | 29.6 |

| Sale-to-List Percentage | 99.8% |

| Percentage of Listings with Price Reductions | 26.9% |

Las Vegas, located in Nevada, is a city that provides limited walkability. It ranks as the 32nd most walkable large city in the U.S. and is home to 583,756 residents. Although Las Vegas does offer some public transportation options, it doesn’t have an extensive network of bike lanes. The downtown area of Las Vegas, famous for its casinos and hotels, stands out as the most accessible neighborhood in the city. However, housing options in this area are relatively limited. Las Vegas has a mix of owner-occupied and renter-occupied housing units, making it a significant rental property market.

The strong job market in Las Vegas is a significant factor fueling this growth. With major industries like hospitality, gaming, and entertainment, the city offers plentiful employment opportunities that attract many individuals to relocate. As a result, the increased demand for housing in the area contributes to the rise in home values.

Conclusion

Whether you’re looking to buy your dream or make an investment, 2023 could be the perfect time to get started. After a slowdown in housing markets last year, the spotlight is now turning towards markets with a reputation for steady and reliable performance.

These are the markets that have consistently maintained a pace. It’s expected that they will continue to remain active throughout 2023. And mind you, it’s always good to do more research before making real estate investments.

All data source: FRED All image source: Wikipedia